- upload bom file

- +86 0755-82770375

- sales@bomkitting.com

Why have Silicon Labs chips been out of stock recently?

Analysis of Silicon Labs Chip Shortage and Company Performance (Unit Conversion Version)

In mid-August, a member of the Bom Kitting Chip Distribution Club asked in the group chat: "It seems that Silicon Labs chips are in short supply, and many people are looking for them." Some other members also mentioned that they sold out a batch of chips before they even had time to hold onto them.

Source: Bom Kitting Club Group Chat

By reading this article, you will learn: Which Silicon Labs chips are in short supply and their applications? Why is there a shortage? What kind of company is Silicon Labs (the original manufacturer) and how is its performance?

01 MCU Shortage and Price Increase, Rising Demand

Multiple distributors specializing in Silicon Labs stated that some models of Silicon Labs are indeed "experiencing a slight shortage" recently. Demand has been gradually picking up since April this year, and after a slight price increase, it remained stable until the market became noticeably booming in July. However, not all products are in short supply; this wave is mainly related to drone applications.

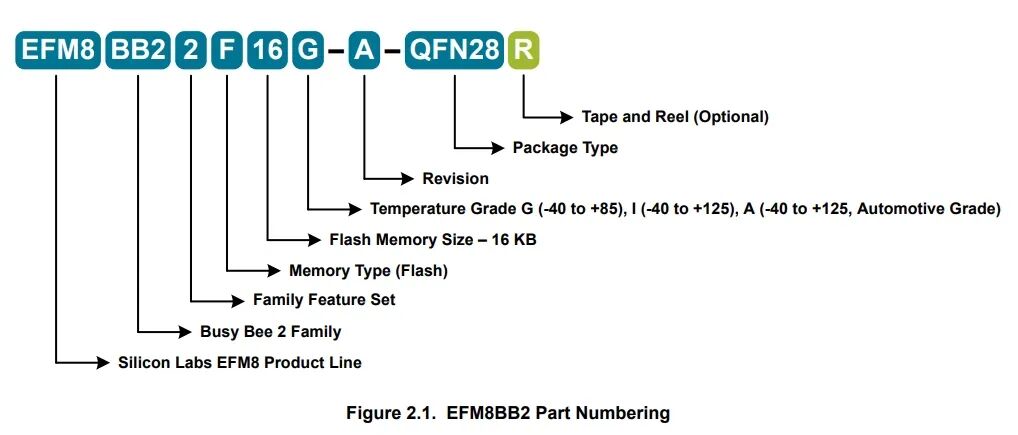

The key products in this market trend are Silicon Labs' ESC (Electronic Speed Controller) MCU chips, mainly concentrated in the EFM8 BB5 series and EFM8 BB2 series. In addition, Silicon Labs' IoT SoCs (such as the EFR32MG21 series) have also gained certain market attention.

Currently, the popular EFM8 models include EFM8BB51F16G-C-QFN20R and EFM8BB21F16G-C-QFN20R. There has even been a doubling in prices; for example, the price of EFM8BB51F16G-C-QFN20R has risen from approximately $0.42 (converted at the average RMB-to-USD exchange rate of 7.15:1 in May 2024) to around $0.84 now.

The EFM8 BB (Busy Bee) series belongs to Silicon Labs' 8-bit general-purpose MCU family, featuring small packaging and multi-functionality.

Among them, the EFM8BB51 is based on a wide-voltage 8051 platform with an operating frequency of 50MHz, and is commonly used in home appliances, toys, battery packs, and optical modules. The EFM8BB21, on the other hand, is oriented towards a low-power platform, also with a main frequency of 50MHz, suitable for motor control, consumer electronics, sensors, high-speed communication hubs, medical care, and lighting scenarios.

Among them, the EFM8BB51 is based on a wide-voltage 8051 platform with an operating frequency of 50MHz, and is commonly used in home appliances, toys, battery packs, and optical modules. The EFM8BB21, on the other hand, is oriented towards a low-power platform, also with a main frequency of 50MHz, suitable for motor control, consumer electronics, sensors, high-speed communication hubs, medical care, and lighting scenarios.

.png)

Source: Silicon Labs Official Website

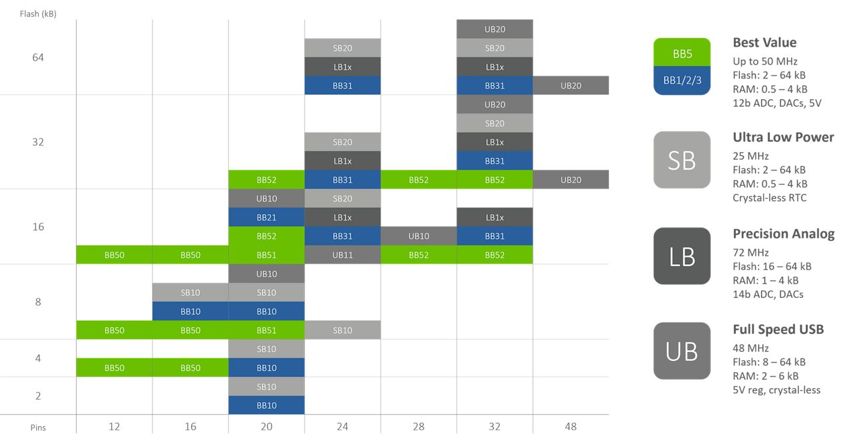

In addition to the Busy Bee series, the EFM8 family also includes the EFM8 SB (Sleepy Bee) series for ultra-low power consumption, the EFM8 LB (Laser Bee) series with outstanding high-precision analog characteristics, and the EFM8 UB (Universal Bee) series as small-sized, low-power USB microcontrollers. Together, they form Silicon Labs' complete product layout for the EFM8 series MCUs.

Source: Silicon Labs Official Website

These chips are mainly used in the ESCs of drones. As the core component of the ESC, the main control MCU can drive the motor and adjust the rotation speed, thereby ensuring the flight stability of the drone.

According to a foreign FPV drone platform, the commonly used MCUs for multi-rotor ESCs on the market include those from ATMEL, Silabs, and ARM Cortex architectures. The overall performance rating of relevant 8-bit MCU products (from best to worst) is: BB5/BB2 > BB1 > F39X > F330 > Atmel-8 bit.

In comparison, Silicon Labs' Busy Bee series supports hardware PWM and DShot ESC protocols, providing more stable throttle response. With its leading performance among these 8-bit MCUs and cost-effectiveness, it has become a popular choice for drone ESCs.

Some distributors revealed that the earliest batch of Silicon Labs chips to alleviate the shortage will arrive in September, and the shortage will gradually ease.

Other distributors also mentioned that, to their knowledge, the normal delivery cycle is 8-12 weeks, so receiving goods in September is relatively early.

Checking some agency platforms, the original manufacturer's delivery cycle for models like EFM8BB51F16G-C-QFN20R is 16 weeks; orders placed now are expected to be shipped by the end of December. For EFM8BB21F16G-C-QFN20R, the original manufacturer's delivery cycle is 20 weeks, and orders placed now are expected to arrive at the platform in January next year, with inventory almost exhausted.

Silicon Labs' major agents include Arrow Electronics, WT Microelectronics, Mouser Electronics, Yosun Electronics, Element14, RS Components, Alcom, and SEKORM, among which Arrow Electronics and WT Microelectronics contribute approximately 43% of the company's revenue.

The limited channels in the chip spot market, combined with man-made factors, have led to this round of partial shortage and price increase.

Overall, this is not a comprehensive shortage. As subsequent restocks of some products arrive, the situation is expected to gradually ease.

02 Recovering Performance, Targeting the Trillion-Dollar IoT Market

Briefly introducing Silicon Labs: Founded in 1996, it is a Fabless analog chip design company focusing on low-power wireless connectivity, providing analog-intensive mixed-signal solutions for various electronic products in the IoT field. Currently, its chip production mainly relies on foundries such as TSMC and SMIC.

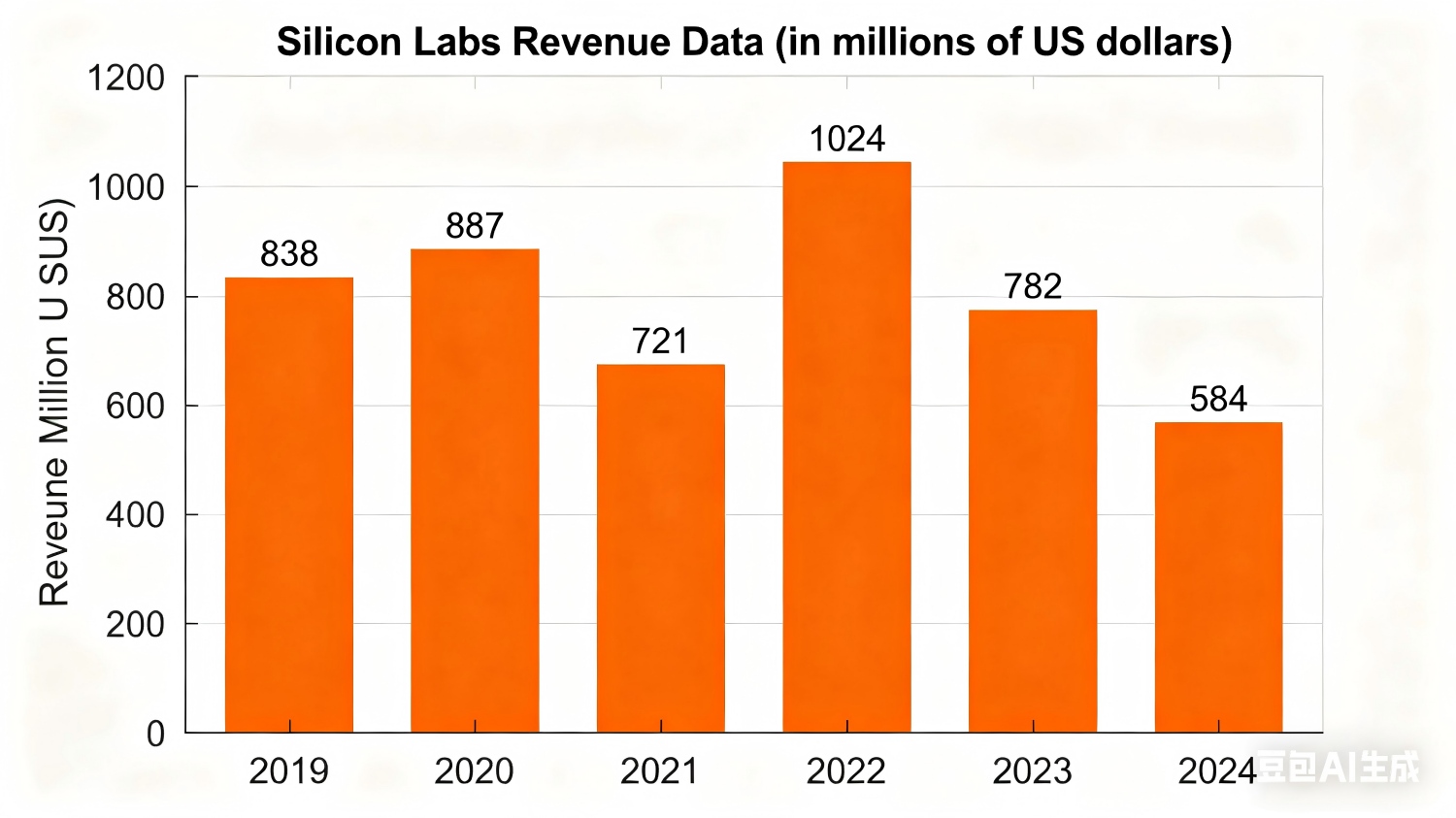

In terms of scale, Silicon Labs is not particularly large; its revenue in 2024 was $584 million. Among this, 67% came from the distribution channel and 33% from direct sales. In 2024, 90% of its revenue came from regions outside the United States, with approximately 15% from the Chinese market.

According to Silicon Labs, the company continuously expands its product portfolio, launching innovative products and solutions through a dual-track strategy of organic growth and mergers & acquisitions. Due to the significant efforts and time invested in the customer design process, the product life cycle is relatively long. The revenue of fiscal years 2024, 2023, and 2022 mainly came from the sales of mixed-signal products.

Looking back at the past few years, Silicon Labs once exceeded the $1 billion revenue mark in 2022. However, as the industry entered a downward cycle, its performance gradually came under pressure. In 2024, its revenue dropped to $580 million, lower than the $720 million in 2021. Its gross profit margins from 2022 to 2024 were 64.3%, 58.9%, and 53.4% respectively, showing a downward trend.

Source: Public Data, Compiled by Bom kitting

Compared with the previous year, both the sales volume and average selling price of Silicon Labs' products decreased in 2024. To address the inventory backlog caused by supply chain disruptions in fiscal years 2021-2022, customers continued to reduce inventory, leading to the weak customer demand that the company encountered in the second half of 2023 continuing into fiscal year 2024.

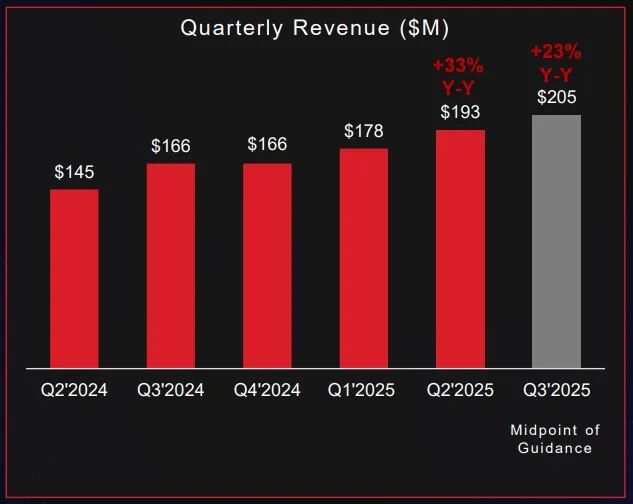

However, since the end of 2024, the situation has begun to improve. Compared with the trough in the fourth quarter of 2023, its revenue has achieved a growth of over 90%. This is due to the continuous improvement in excess customer inventory and order volume, as well as the increase in market share in niche segments. In the second quarter of 2025, the company's revenue reached $193 million, a year-on-year increase of 33% and a quarter-on-quarter increase of 9%, exceeding market expectations for four consecutive quarters.

In terms of business structure, Silicon Labs is mainly divided into two segments: Industrial & Commercial (accounting for 58%) and Home & Lifestyle (accounting for 42%).

Among them, the revenue of the Industrial & Commercial business increased by 25% year-on-year in the second quarter of this year; the Home & Lifestyle segment performed even more strongly, with a year-on-year growth of 45%, driven by the continuous expansion of smart home, healthcare, and industrial applications. Inventory levels have also improved: the inventory days in the second quarter dropped to 86 days, further improving from 94 days in the first quarter.

Among them, the revenue of the Industrial & Commercial business increased by 25% year-on-year in the second quarter of this year; the Home & Lifestyle segment performed even more strongly, with a year-on-year growth of 45%, driven by the continuous expansion of smart home, healthcare, and industrial applications. Inventory levels have also improved: the inventory days in the second quarter dropped to 86 days, further improving from 94 days in the first quarter.

Source: Silicon Labs Investor Report, August 5, 2025

Looking ahead, Silicon Labs expects its revenue in the third quarter of 2025 to be between $200 million and $210 million, a year-on-year increase of 23%. Analysts predict that Silicon Labs' full-year revenue in fiscal year 2025 will grow strongly by 35%, and its gross profit margin is expected to rise to 57%-58%. Silicon Labs anticipates that its performance will outperform the broader semiconductor market, with a significant increase in customer demand.

It is worth mentioning that Silicon Labs has made a clear strategic choice: to shed non-core businesses and fully embrace the IoT.

As early as 2012, Silicon Labs clearly defined IoT (Internet of Things) as its core development direction. It has expanded its IoT hardware and software product portfolio through continuous acquisitions—from 2012 to 2020, it carried out mergers and acquisitions almost every year, enriching its IoT hardware and software product mix and gradually building a complete IoT ecosystem.

As early as 2012, Silicon Labs clearly defined IoT (Internet of Things) as its core development direction. It has expanded its IoT hardware and software product portfolio through continuous acquisitions—from 2012 to 2020, it carried out mergers and acquisitions almost every year, enriching its IoT hardware and software product mix and gradually building a complete IoT ecosystem.

In 2021, the company sold its Infrastructure & Automotive (IA) business to Skyworks for $2.75 billion, which included product portfolios such as power supplies, isolation, timing, and broadcasting. This business contributed $375 million in revenue in fiscal year 2020, accounting for approximately 42.3% of Silicon Labs' total revenue.

After divesting the IA business, which had been experiencing declining revenue, Silicon Labs has completely transformed into a player focusing on IoT wireless business. In 2021, the company set a goal, stating that its IoT products and technologies "will cover a $10 billion market" (as of 2023).

Source: Fortune Business Insights Compiled by Bom kitting

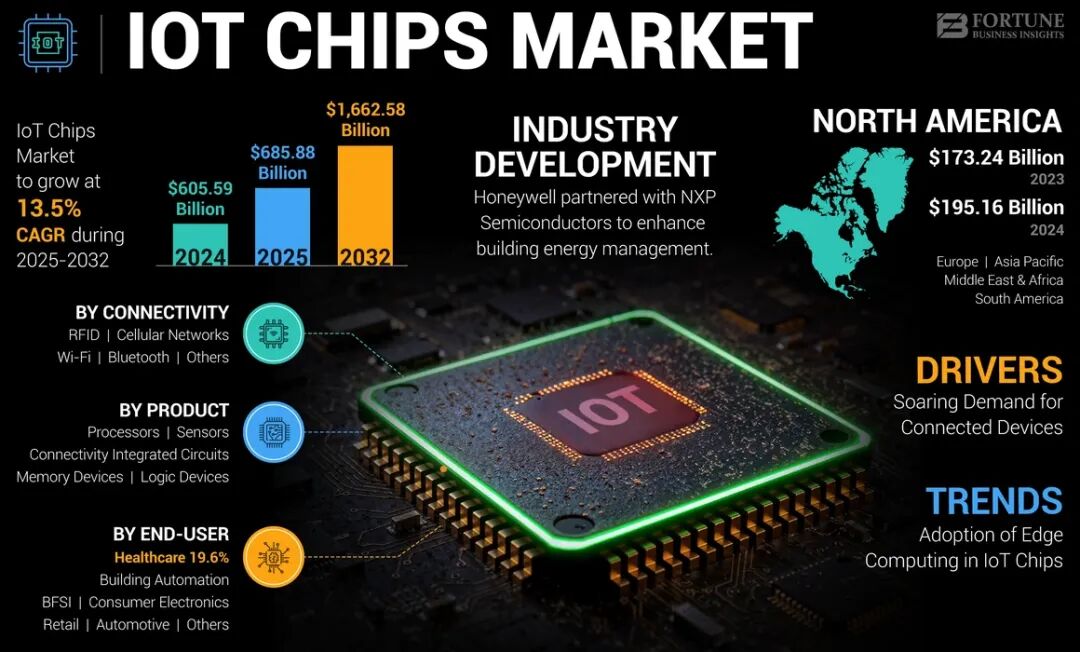

According to Fortune Business Insights, the global IoT chip market size was $605.59 billion in 2024, and it is expected to grow from $685.88 billion in 2025 to $1.66258 trillion in 2032, with a compound annual growth rate (CAGR) of 13.5%. In 2024, North America dominated the global IoT chip market with a 32.23% market share.

Against the backdrop of the hundred-billion-dollar blue ocean market for IoT chips, Silicon Labs' goal seems more like a starting point.

03 Conclusion

Overall, this round of shortage and price increase is not a comprehensive shortage but is concentrated in niche applications such as drone ESC MCUs. It is more of a combined effect of the rapid rise in demand and tight supply in the spot market. Although Silicon Labs is a relatively niche brand, its in-depth cultivation in the IoT wireless and MCU fields has given its products scarcity in specific tracks, making its market trends attract attention.

Note

Basis for RMB-to-USD Conversion in the Article: Calculated based on the average RMB-to-USD exchange rate of 7.15:1 announced by the China Foreign Exchange Trade System in May 2024 (within the knowledge cutoff date). This conversion is only for the convenience of reading with a unified unit and does not represent the real-time transaction exchange rate.

Compiled by Bom kitting

Newsletter

Wait...

Friendly Urls : Marking Search

Copyright © 2025 bomkitting. All rights reserved.